Fintech Industry plays various roles to make your life easy as far as finance is concerned. Like today in your village or anywhere in the city, if you want to transfer money from world to another place, you can do it simply through Aadhar card or if you want to recharge mobile phone, DTH or want to Pay electricity bill, need services related to income tax, GST. If you want to make a website or want to make a PAN card etc. Fintech is the one-stop solution for all the mentioned services. Now let’s discuss it in brief.

Table of Contents

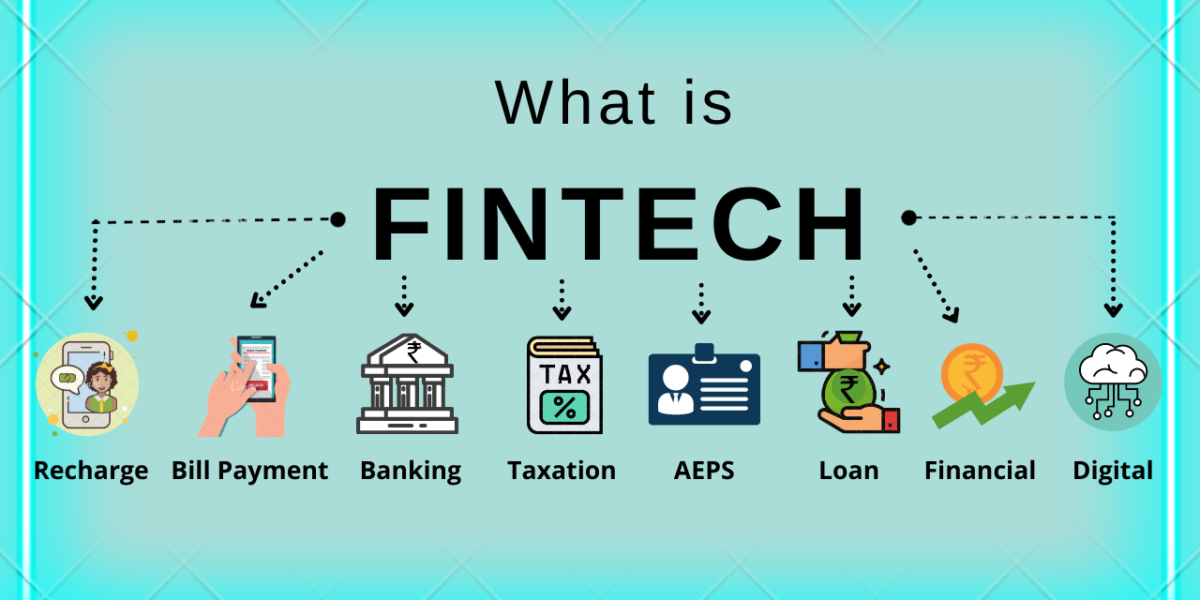

What is Fintech Industry?

Fintech is a combination of the term “finance” and “technology” which are used to explain a new technology. It is brought to improve and automate the delivery and use of financial services.

Finance technology uses specialized software and algorithms used in smartphones. It helps financial technology companies, business owners, consumers better manage their financial operations, processes and lives.

Fintech now describes a variety of financial activities. Such as money transfer, depositing a check with your smartphone bypassing a bank branch to apply for credit raising money for a business start-up or managing your investment, without the assistance of a person.

This industry now covers different sectors such as Education, Retail Banking, Mobile payment, GST, Digital Marketing and many more. According to the year 2017, Fintech adoption index, one-third of consumers utilize at least two or more Fintech services.

Importance of Fintech Industry

The Fintech industry is rapidly growing that serves the interest of both consumers and businesses in various ways. From banking and insurance to payment and investment apps, fintech has an apparently huge formation of the application.

The growth of the fintech industry is a key part of the opportunities for young players to meet in the fintech industry as a traditional institution. Thanks to Fintech, it is not a question of who is bigger, but who is faster to effectively meet the ever-changing needs of customers.

Additionally, they offer targeted often niche services that fill the gap of a particular financial need, sometimes at a much lower cost than those offered by traditional financial providers.

As consumers have become even more economical and connected, efficient Fintech companies will continue to find new solutions to old problems.

How does Fintech Industry work?

Fintech is not a new industry, it is simply an industry that has developed very rapidly. Technology has always been involved with the financial world.

Whether it’s the entry of credit cards in the 1950s or ATM, electronic trading floors, personal finance apps and high-frequency trading in the decades that followed.

In fact, the Fintech industry is kinda the regulated solution to solve problems regarding financial services like banking, insurance, loan etc.

As Fintech has grown so much it is somehow concerned regarding cybersecurity in the fintech industry. The rapid growth of fintech companies in the global marketplace has led to risk in Fintech infrastructure. It has also become a target for cybercriminals’ attacks.

Fortunately, technology continues to develop to reduce existing fraud risks. That’s by it became trustworthy and efficient.

Services covered under Fintech Industry

-

Digital lending and credit:

Digital lending and credit refer to the online provision of loans where loan approval and recovery take place through mobile apps. Loan apps comprised just 4.9% of all apps installed in India in October 2020 but rose by 11% in October 2021. Digital lending is projected to reach $350 billion by 2023.

-

Mobile Banking:

Mobile banking app facilitates checking account balances and lists of the latest transactions, electronic bill payments, remote check deposits, P2P payments and fund transfer. Such service reduces the need for customers to visit a bank branch. Mobile Banking differs from mobile payments. It uses to help in business situations as well as in financial situations.

-

AEPS:

Aadhaar enabled payment system is a bank-led model which allows online financial transactions at Micro-ATM through the Business correspondence of any bank using the Aadhaar authentication. The AEPS is a system through which you can transfer funds, make payments, deposit cash etc.

-

Mobile Payment:

Mobile payment refers to payment services operated under financial regulation It is performed from a mobile device, instead of paying with cash, cheque or credit card, a consumer can use a mobile to pay. It is becoming a key instrument for payment service providers and other market participants.

-

Insurance:

Banks are partnering with Fintech enterprises to operate at lower costs. Banking institutions have entered the Fintech space as an inspiration for digitalization. The insurance industry is a systematic change in business operations, not unlike the transformation banking institutions are skillfully mastering now.

Fintech Users

There are four broad categories of users of fintech

- B2B(business to business)for Banks

- Their business client

- B2C for small business

- Consumers

Consumer: Consumer-oriented fintech is mostly targeting millennials as it is a huge size that is digitally aware. There is rising earning potential of the talked about segment.

Some fintech watchers believe that this focus on millennials has more to do with the size of that marketplace than the ability and interest of the Generation in using fintech.

Business: A business owner or start-up would have gone to a bank to secure financing or startup capital. If they intended to accept credit card payments, they would have to establish a relationship with a credit card payment.

They would have to establish a relationship with a credit provider and even install infrastructure. Now, with mobile technology, these hurdles are a thing of the past.

Nutshell

Fintech Industry is a problem-solving industry and it has a huge scope as far as customer service niche is concerned. However, this Industry mainly focuses on customer problems and gives the solution to them. When the two most prominent industries (Finance and technology) work together, it kinda makes customer life easy and more comfortable. This industry offers daily problem-solving services, that,s by customer prefer these services to lower the burden of daily life problems and responsibility.